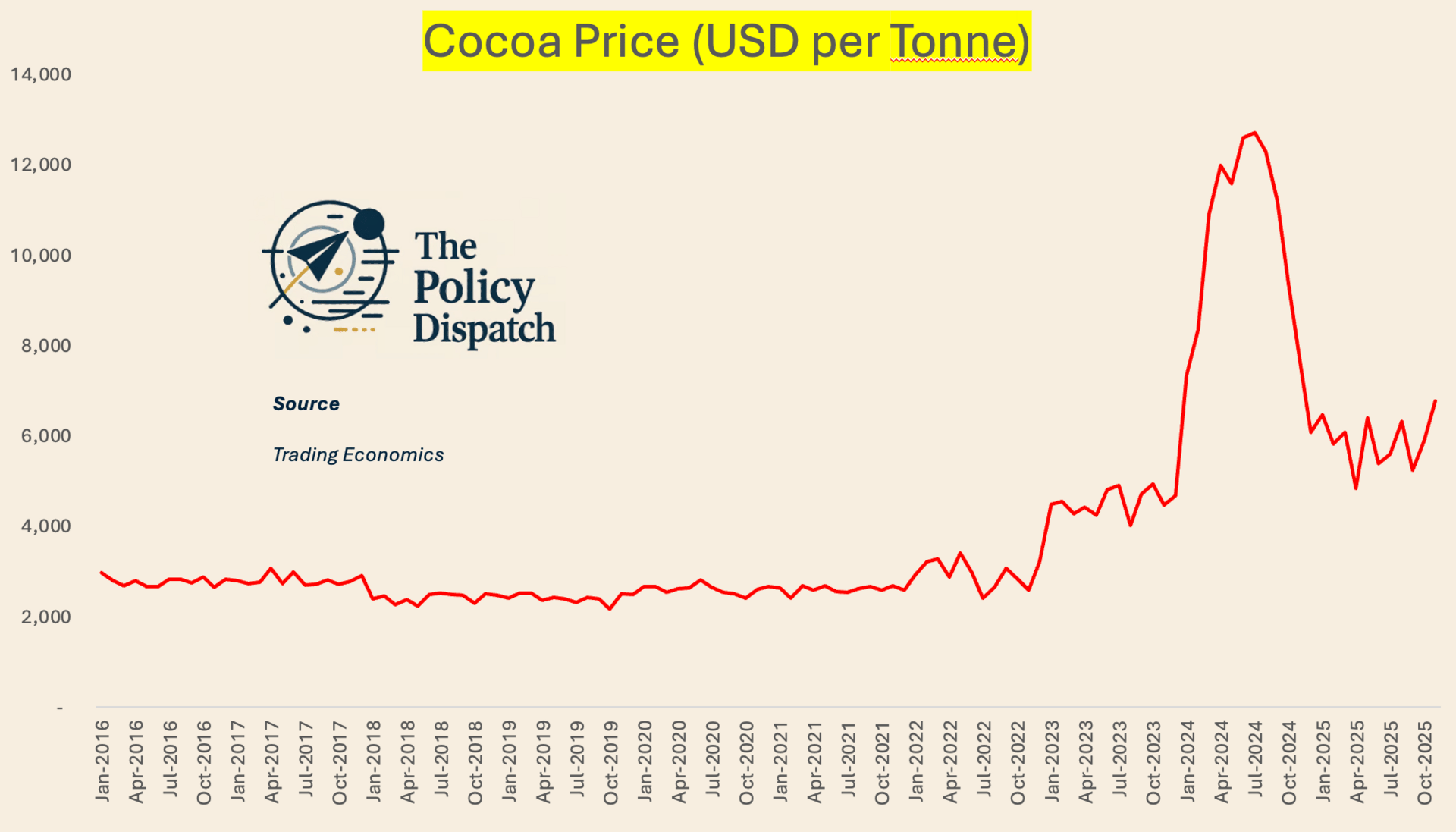

Hello, this week we are delving into the economics of Cocoa. Cocoa prices have been in the news quite a bit this year for its very high prices. As the end of year approaches and chocolate is usually an easy gift, the prices of chocolate at the supermarket may make you think twice.

This newsletter is sponsored by Rundown AI & The Hustle. Check them out at the end of this newsletter. It helps us grow and keep this newsletter alive.

A simple analysis of the articles published about chocolate from mainstream media organisations since January 2022 show that the main focus has been on the following:

Price hikes in chocolate prices announced by various brands

How poor harvest has been impacted by diseases in West Africa.

How poor weather conditions have contributed to lower yield.

How shrinkflation (When products reduce in size while remaining the same price) has affected consumers.

Experiments to introduce lab-grown cocoa.

How tariffs are affecting chocolate prices.

wordcloud of keywords in articles since January 2022

You’ll observe that the words “farmers” or “pay” do not show up. The word “margins” does show up and these reflect articles that mentioned the profit margin of retailers.

Behind all those headlines and keywords, lies another reality - that of farmers unable to capture the fruit of their labour (no pun intended). A recent study by the FAO entitled “Comparative study on distribution of value in European chocolate chains” (2024) lays out the issue of uneven profit margins amongst different actors of the supply chain of chocolate. Even more intriguing is the fact that no mainstream media has taken up the conclusions of the study (not as sexy as an el-nino destroying cultivations maybe?).

It is estimated that cocoa producers / farmers receive on average only 11% of the final price and a high percentage of them live under the poverty threshold. The margins vary from country to country but the difference are only within a few percentage points.

To try raise the income that farmers receive in Ivory Coast, the government introduced a policy instrument called “Living income differential” in 2020. it adds a fixed amount of $400/tonne to the standard price of cocoa to increase payments to farmers. Those premiums are meant to be paid by importing companies. Based on 2022 cocoa prices, that represents an approximate 37-39% increase to farmers.

The scheme has had mixed results though. As the scheme depends strongly on premium, those are dependent on the supply of cocoa. If the supply of cocoa increases substantially, the prices fall and even by adding the premium, prices may not increase much.

Companies importing cocoa have also not played the game. They have found ways to avoid paying the premium by buying cocoa on secondary markets. Moreover, as some of those companies are giants in the industry, their leverage on prices are disproportionate compared to sellers.

A paper published in 2023 suggests a number of proposals to make the Living Income Differential more effective:

Coordination in production growth across producing countries.

Find ways to incentivise importers to cooperate.

Higher transparency and monitoring to make sure the premium is reaching farmers and not being eaten away somewhere else in the chain.

A bigger voice to farmers.

Accompanying policies to raise yields and build resilience.

If the economics of the cocoa were to change, the focus needs to change to:

having close to real time data on farmers’ earnings and profit margins. It is easier to get the price of a chocolate in Walmart than to find the average earnings of a cocoa farmer in Ivory Coast. As long as the data is not available at a regular frequency, the narrative about the industry will not change. Maybe the creation of a label similar to that for nutrition would help show fair profit margins for planters ?

A recent report by Include Platform makes this point clear. In addition, they also advocate for:

Using a broader term for “farmers” to include their families, share-croppers, caretakers and daily labourers. Consumers need to be aware of those “invisible farmers”.

These “invisible” farmers are rarely captured in data and outreach efforts.

Indirect suppliers of Cocoa remain poorly traced and documented - impeding accountability. Companies further along the supply chain need to invest more to map out all their suppliers.

The profit margins of different actors of the supply chain need to be made public so the broader public can know where their money is going. Without financial transparency, fairness in profit sharing will not be achieved. What justifies a higher profit margin for a chocolate producer versus a cocoa producer ?

As long as economic systems remain opaque, fairness and fair pay will remain hard to achieve.

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

200+ AI Side Hustles to Start Right Now

AI isn't just changing business—it's creating entirely new income opportunities. The Hustle's guide features 200+ ways to make money with AI, from beginner-friendly gigs to advanced ventures. Each comes with realistic income projections and resource requirements. Join 1.5M professionals getting daily insights on emerging tech and business opportunities.